Kurs Fundrix:

Track Live Crypto Price Activity with Kurs Fundrix AI

Sign up now

Sign up now

Kurs Fundrix applies advanced machine learning systems to observe cryptocurrency market behavior as it unfolds. Transaction flow, volume shifts, and evolving liquidity conditions are assessed continuously to surface meaningful developments that may not be visible through standard indicators.

Only critical market movements generate alerts, allowing users to remain focused without constant noise. This selective notification framework helps maintain attention on changes that carry analytical significance rather than short lived fluctuations.

As directional bias strengthens or reversal pressure begins forming, Kurs Fundrix records each event with precise timing and contextual labeling. This structured insight framework supports disciplined decision making in environments where cryptocurrency markets are highly volatile and losses may occur.

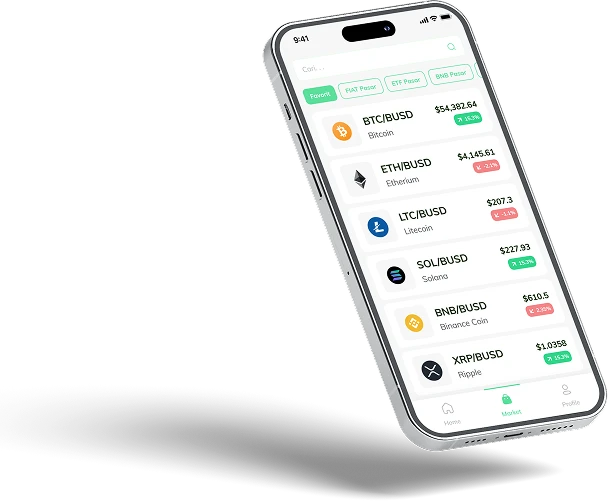

Kurs Fundrix tracks price behavior at moments when direction begins to shift rather than relying on delayed historical references. Sudden expansions sharp pullbacks and fast order flow changes are processed instantly and displayed as clearly organized insights. Older market data is filtered out so attention remains on forces actively shaping movement. This design transforms unstable price action into timely analytical awareness.

Rather than reacting to surface level price movement, Kurs Fundrix evaluates instability where it begins. Shifts in momentum intensity liquidity tension and movement speed are examined together to organize disorderly behavior into meaningful analysis. Signals are presented with clear context and priority allowing users to rely on measured interpretation during periods when cryptocurrency markets are highly volatile and losses may occur.

Kurs Fundrix continuously observes active market behavior and adapts instantly as conditions shift. By reviewing participation flow sentiment response and multiple validation layers it surfaces directional awareness before trends become widely visible. Market complexity is refined into structured guidance supported only by confirmed momentum signals.

Kurs Fundrix provides methodical analytical pathways created to support different trading approaches without automating execution. Control remains fully manual while the platform delivers verified insights adjustable parameters and ongoing market observation. Each framework emphasizes measured risk awareness progress tracking and data backed reasoning during periods when cryptocurrency markets are highly volatile and losses may occur.

Kurs Fundrix is designed with a security centered foundation. Encrypted infrastructure and controlled access layers safeguard sensitive information while analytical operations remain fully separated from capital and personal financial records. A monitored AI driven environment continuously validates system integrity without retaining unnecessary user data.

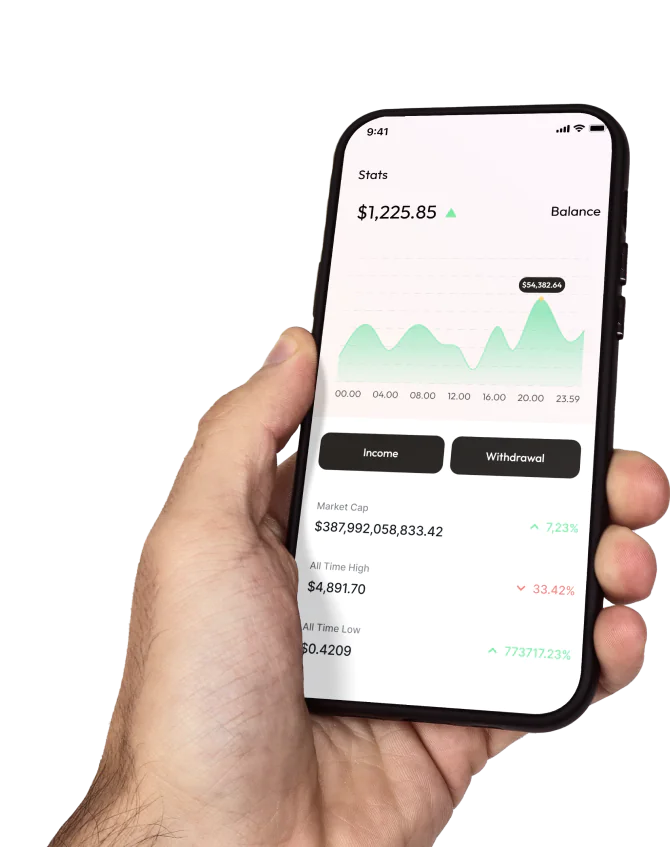

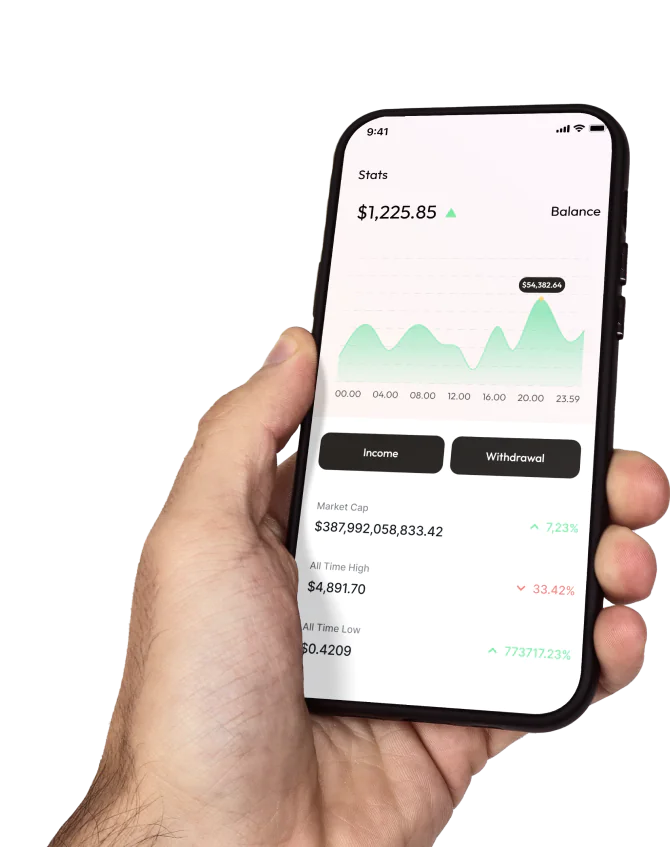

Kurs Fundrix delivers a refined workspace where behavioral shifts key zones and evolving price structures are presented with clarity. Algorithm based visuals replace speculation allowing strategy comparison performance review and confident observation of market transitions.

Kurs Fundrix observes real time price behavior to recognize emerging momentum at the earliest stage. Each signal is time stamped and contextualized to ensure relevance and accuracy based on active market conditions. Cryptocurrency markets are highly volatile and losses may occur.

Kurs Fundrix condenses complex price behavior into concise insight displays that emphasize meaningful structural changes. Signals reflect current conditions highlighting momentum adjustments while filtering out outdated or irrelevant market noise.

Kurs Fundrix refines its analysis continuously as conditions evolve. Liquidity shifts strength variation and breakout behavior are tracked live ensuring insights remain aligned with present activity rather than static chart references.

Signals are processed through structured momentum evaluation models to remove distraction. Kurs Fundrix isolates genuine directional development providing dependable insight across varying environments.

As balance shifts occur Kurs Fundrix responds without delay. Volume expansion directional movement and pressure buildup are identified immediately offering clear visibility into unfolding events.

Kurs Fundrix features a focused layout with intuitive controls enabling fast configuration and contextual evaluation. Each tool supports clarity speed and disciplined decision making.

Kurs Fundrix organizes active market behavior into a coherent intelligence framework by evaluating trader interaction response speed and directional pressure. Market structure is presented visually to clarify how trends develop rather than merely displaying final price results.

Live data is fed into layered momentum analysis models that remain stable during sharp or uneven movement. This continuous integration supports steady interpretation even when price behavior becomes irregular.

A protected analytical environment with encrypted computation controlled permissions and adaptive oversight preserves insight accuracy. All calculations remain synchronized with real time activity while eliminating distortion and unnecessary market noise.

By aligning movement strength breakout validation activity zone positioning and depth aware assessment Kurs Fundrix detects momentum formation at its earliest point. Alerts appear only after clearly defined conditions are met to maintain analytical precision.

Trend development is reviewed using a phased evaluation system that examines speed variation directional consistency and repeated signal confirmation. Minor fluctuations are removed leaving structurally reliable indicators that support informed market decisions. Cryptocurrency markets are highly volatile and losses may occur.

Kurs Fundrix tracks early transition behavior before directional movement becomes widely apparent. Subtle changes in pressure velocity and signal integrity are captured immediately to maintain alignment with current conditions.

Analysis is structured to support varied engagement styles. Rapid guidance supports short duration activity while broader context driven insight assists longer horizon evaluation.

Flow based monitoring by Kurs Fundrix highlights initiation buildup and potential inflection points. Each phase is weighted logically to support disciplined timing assessment.

Multiple possible market developments are evaluated simultaneously linking outcome probability with strategic structure. Kurs Fundrix reviews strength response behavior and pressure zones while maintaining historical reference for future preparation.

Kurs Fundrix converts active price movement into clearly defined market zones through spatial modeling and momentum evaluation. Instead of crowding the interface with excessive chart detail, the system isolates regions where expansion or reversal probability increases. When converging forces appear, these zones are surfaced automatically for focused review.

The analytical framework follows the evolution of price energy across time. Compression cycles rotational behavior and structural weakening are tracked simultaneously to determine whether movement strength is building or fading. Validated zones provide objective reference points that reduce uncertainty and support confident evaluation.

Only indicators with demonstrated performance relevance are prioritized. Visuals adjust dynamically while an internal scoring mechanism ranks opportunity quality, encouraging consistent logic driven decisions rather than emotional reactions.

Market narratives emotional reactions and rapid information spread can distort perception. Kurs Fundrix counters this by measuring communication speed engagement intensity and narrative momentum across multiple data streams. Emotional influence is analyzed independently and then compared against actual price behavior to minimize distortion.

Sentiment movement is monitored across short and extended intervals capturing sudden reversals before they become visible in price action. Both magnitude and acceleration are assessed to expose weakening confidence beneath surface activity.

By merging sentiment evaluation with live price dynamics Kurs Fundrix provides balanced market perspective. When emotional direction diverges from structural strength alerts are generated to support measured decisions in environments where cryptocurrency markets are highly volatile and losses may occur.

Digital asset markets often respond quickly to economic developments such as policy updates or labor data. Kurs Fundrix observes these inputs as they emerge assessing relevance timing and potential influence before converting them into structured insight.

The analytical engine links macro level developments with live crypto pricing. Historical comparison highlights moments where external data aligns with early directional movement filtering out irrelevant information.

By combining automated evaluation with rule guided analysis Kurs Fundrix delivers a refined view of crypto market behavior. Directional trends liquidity concentration and fragmented activity are monitored continuously with alerts issued for irregular developments.

Signals are ranked by relevance and price action is interpreted within full market context rather than isolation. The intuitive interface maintains user control while supporting thoughtful confident evaluation.

Small variations in price often precede broader shifts. Kurs Fundrix compares subtle deviations with historical structures enabling early opportunity recognition and supporting proactive analysis over reactive behavior.

Sudden price movement can occur without notice. Kurs Fundrix tracks these developments as they happen identifying response zones and delivering concise scenario context. Each alert clarifies origin intensity and near term impact.

Continuous observation of price behavior allows Kurs Fundrix to surface trends in their early phase. Directional adjustment pressure accumulation and potential reversal zones are outlined to support disciplined evaluation.

Rapid price swings can disrupt judgment yet Kurs Fundrix delivers consistent structured insight. Alerts rely on standardized validation metrics ensuring signals represent genuine market behavior rather than impulsive noise.

Kurs Fundrix integrates advanced modeling with systematic review to track order flow stress identify reaction zones and clarify directional bias. Live monitoring of volume sentiment and momentum provides actionable context while all execution decisions remain user controlled.

The real time signal engine adjusts instantly to sudden expansion or contraction. Structured logic and disciplined assessment support effective risk awareness in fast moving crypto environments.

Kurs Fundrix converts complex cryptocurrency activity into clear analytical understanding. AI driven dashboards and structured logic interpret market behavior while all trading actions remain entirely user controlled.

Yes. Kurs Fundrix offers a guided experience through intuitive visuals streamlined tools and straightforward navigation. As familiarity increases advanced features such as scenario modeling and deeper metric review support stronger analytical development.

No. Kurs Fundrix is designed exclusively for market observation opportunity identification and structured insight delivery. All trade execution decisions remain with the user. Cryptocurrency markets are highly volatile and losses may occur.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |